Term Deposits Vs Revolving Credit

I routinely read the Saturday business columns of the likes of Mary Holm & Diana Clement. There are some great bits of advice that they offer.

I’ve noticed in several instances a few readers fall into this category:

- They still have a mortgage &

- Have a decent chunk of savings put aside or

- Have been given an inheritance

They are writing in and asking; “What should I do with my money? Clear the Mortgage, Save or Invest?”

Normally it’s an either or scenario and the advice given is always exactly that either; invest, save or pay down debt based on their age and appetite for risk. Rental properties are often advised against but more on that in another newsletter.

I am saying you can and should do all three!

Still have a Mortgage? Savings is Dead!!

The key point here is that the readers still have a mortgage.

What I haven’t seen discussed by either Mary or Diana is the use of a Revolving Credit Facility (RCF) utilized to pay their loan off faster.

You see for people who still have a mortgage the most powerful tax free, guaranteed investment you can make is to pay down your Mortgage asap (actually higher interest bearing debt like Credit Cards, but more on this next time).

Think about it. The savings are truly guaranteed and of course tax free!

Can you think of a Kiwisaver fund, Superannuation, Term Deposit or anything else for that matter that can say the same thing?

See for your money to be working harder for you in a Savings account, Term Deposit or Investment fund etc… it would need to be earning year in year out with no dips or fluctuations a guaranteed 8.5% or more in interest!

That’s because Investment returns and earned interest are all forms of taxable income.

Now apply say a 25% Tax rate to 8.0% interest and we are now at just 6.0%, don’t forget those all important management fees! chances are now we are at 5.0% or less!

Just as a quick aside: fund managers and banks still get paid regardless if they earn you money or lose you money!

“Unless if you can find me a savings account or investment fundGuaranteed to return you greater than 8.5% year in year out no exceptions – then you are better off paying down Your Mortgage debt ASAP”.

Right I think you’re on my side now aren’t you?…great!

However the one big problem with a traditional Table Loan Principal & Interest over 25 years, the moment you pay extra money into your loan, that’s it, that money is now gone.

Normally not a problem except banks are great at offering you an umbrella on a sunny day…whereas on a rainy day not so much!

It’s all well and good sending all of your surplus income and savings into the Mortgage but if you need that money again due to unforeseen circumstances then what?

I’ve seen clients who have just lost their job, needing only an extra 2-3 Months income to get them through being declined by their bank because the ‘Main Bread Winner’ is now out of work.

That same bank would have almost fallen over themselves to lend them 3 x the money prior to their plight!

Another great use for a RCF…

Often I meet older clients and they have done very well and have managed to save $80,000 or so. This money is simply sitting in a Term Deposit or Savings account earning say 3.5% interest (at best) less Tax and fees.

Yet they still have a Mortgage, say a standard Principal & Interest loan of $200,000 and the interest on this is say 5.0% p.a.

Like anyone else they love the idea of putting as much as possible against the mortgage to clear it asap and have often been tempted to make big lump sum payments.

But they’re equally afraid to do so as they wouldn’t have access to this money anymore should something happen.

So what should they do?

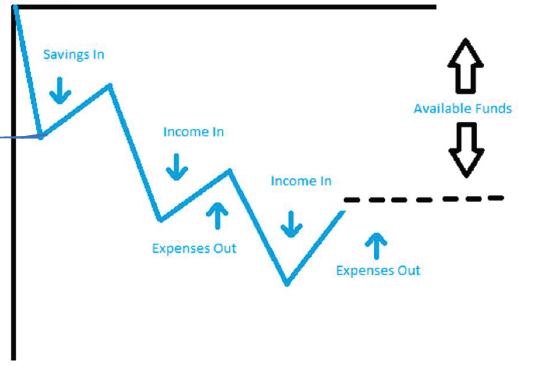

With a Revolving Credit facility it is essentially an Overdraft account attached to your Mortgage. You pay the Floating interest rate based only on the owing balance within this facility. You don’t pay interest on your available credit e.g your equity – why should you? it’s yours! Hence the massive savings potential.

You of course have the ability to redraw your available credit / equity up to the Credit Limit. Often an eftpos card is attached to this facility just like a regular checking account.

So my first piece of advice for the couple is to utilise a Revolving Credit Facility of say $100,000, then fix the remaining $100,000 on a good 1, 2 or 3 Year rate (or a mixture). They then deposit their $80,000 savings into the RCF and now effectively their Mortgage is only $120,000!

Because they have $80k available in this facility they only pay interest on the difference being $120,000.

Should a rainy day come and all too often they do – they still have access to this $80,000 just as if it were in an everyday bank account.

How much are they saving by doing this instead of this same money sitting in a Term Deposit? I’m so glad you asked, lets compare

Term Deposit Over 12 Months

3.5% p.a x $80,000 = $2,800

Minus Tax at a 25% Tax rate (chances are you’re at 28%)

= $2,100

Vs

$80,000 in Revolving Credit Facility Over 12 Months

5.0% p.a (Mortgage Rate) x $80,000 = $4,000

At least $1,900 a year better off simply comparing apples with apples.

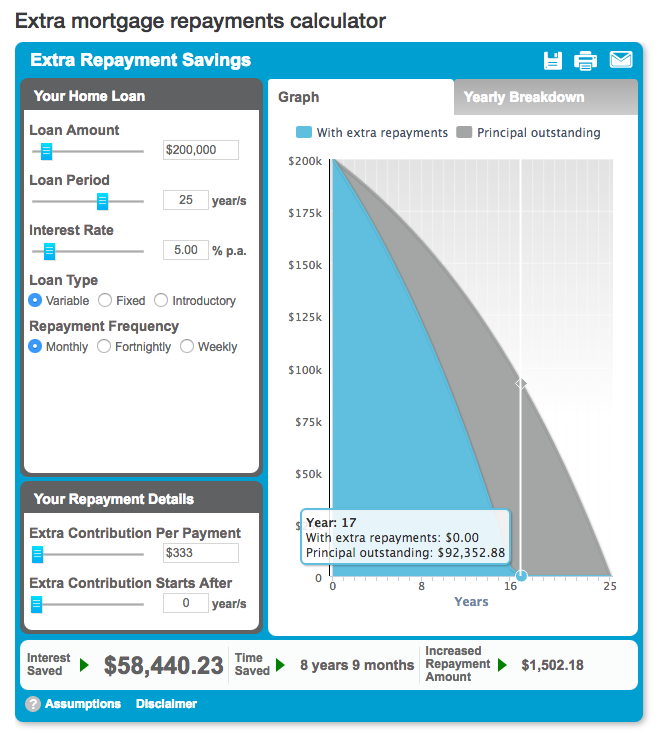

However lets take the $4,000 a year savings and apply this same savings to their Mortgage. Now let’s see what compound Interest has to say on the matter!

By repaying $4,000 more per year ($333 per month) they are now Mortgage free 8 Yrs & 9 months sooner saving a whopping $58,440 over the term of their loan.

That’s my kind of investment! Guaranteed, safe, secure and 100% Tax Free!

Even if you don’t have a significant lump sum of cash right now, a Revolving Credit Facility still makes a lot of sense with any situation as long as you have a small surplus e.g any form of savings left over at the end of the month after accounting for all your expenses.