https://youtu.be/1N5w9whIbRA

Hey Everyone, I’m excited to talk to you about something that I think is pretty darn cool after just completing this exercise myself – relocating a house!

Yes this is all about that time I bought a House (for removal) for $4,000.

Probably because it looked a bit like this…

and this…

Now, I know what you’re thinking… “Matt, why would I want to relocate a house? Isn’t it easier to just build a new one from scratch?”

Well, let me tell you – relocating a house can be a game-changer for a lot of folks. And here’s why:

- Cheaper: First off, it’s ridiculously cost-effective. I mean, who doesn’t love saving some cash, am I right? Building a brand spanking new home can cost an arm and a leg (and maybe even a few internal organs), but relocating a house? Now we’re talking smart money moves. As an investor chasing cash flow and Yield this is particularly attractive. We are talking more than half the cost of a new build often.

- Friendly for the Environment: Secondly, it’s eco-friendly. We all know how important it is to take care of our planet, and relocating a house is a great way to do just that. You’re repurposing an existing structure, which means less waste and a smaller carbon footprint. Win-win.

- Character and Street Appeal: But that’s not all. Relocating a house also lets you preserve history and character. There’s just something special about an older home with unique architectural details and charm that you can’t find in a cookie-cutter new build. Plus, you’re saving a piece of history from being lost or destroyed. Talk about a feel-good move! This is why an old Villa Sourced in say Onehunga and relocated to Ponsonby can be extremely profitable for Owner Occupiers, as it fits into the Character of the neighbourhood.

- Fast: relocating a house can be a much faster process than building from scratch. No need to wait months or even years for your dream home to be built – once your relocated house is in its new spot, it can be quickly renovated and updated to suit your needs.

- Favourible LVR Rules and Tax Rules: Interest is 100% Deductible just like any ‘new build’. Like wise Exempt from the LVR restrictions for property inesvtors currently set at 60% Loan to Value Ratio (LVR).

Downsides

Now, as much as I love the idea of relocating a house, there are a few downsides that we need to consider.

1. First off, covenants on the land can be a bit of a headache. Some areas and new developments have restrictions on the types of homes that can be moved onto a property or the size and/ or the cost of a new build. It’s important to do your research and make sure that the land you’re considering is compatible for relocatables.

I find always make an offer on the land subject to a strong 12-15 days Due Dilligance Clause such as something like this:

24. Due Diligence.

This agreement is entirely conditional upon the Purchaser in its sole discretion being satisfied that the property is suitable for the Purchaser’s intended uses following the Purchaser carrying out due diligence investigations on the overall viability of the property and including but not limited to searching any and all easements, and of any requirements of the local authority or financier, this clause is for the sole benefit of the Purchaser and the Purchaser shall have until 4pm on the 12th working day from the date of this contract to give to the Vendor’s solicitor notice that this clause is satisfied failing which the contract shall be at an end. This clause may be waived by the purchaser prior to the prescribed time at the sole discretion of the purchaser.”

**Use this as a guide only. Get Your Lawyer to check your S&P contract before submitting an offer**

2. Secondly, older building materials can present some challenges, some of the time. Older homes may have materials that are no longer up to code or are less efficient than newer materials. This can mean higher energy costs or the need for upgrades to meet current building standards.

For example generally speaking most councils won’t require double glazing windows for relocatables, however if it’s a home you wish to live in – perhaps you would consider this?

3. Finally, financing can be a lot trickier when it comes to relocating a house. Traditional lenders may be hesitant to provide financing for a home that’s being moved, as the process often doesn’t offer adequate security from day one. It can be done however.

So It’s important to work with a Mortgage Adviser who is experienced in financing relocated homes and can help guide you through the process.

Generally speaking non-bank options will pull through until either the house has been connected to foundations and council sign off, or most definitely when final completion Code of Compliance Certificate (CCC) has issued.

Here are My Own Numbers for my Relocatable

$335,000: Purchase price for a 3 Bedroom, 1 Bath on 1,012 sqm in Ashburton (Sept 2021 – peak of the market!!)

$90,000: Subdivision Cost – 2 separate titles

$4,000: Purchase a 3 Bed 1 Bathroom, 1960’s dwelling. 106 sqm dwelling in ChCh off a Developer for just $4,000.

This was particularly cheap as they needed it gone to build 4 brand new townhouses!

Secondly this house had Brick Cladding (which can’t be relocated), which I argued would cost me much more.

In essence, quite simply there was not a queue of buyers willing to pay more and at the end of the day I saved them $10k+ in demolition costs. So they Netted $14,000. Win, Win! I just had to meet their deadlines.

$65,000: Relocation and Foundations fees.

This was a 3 Piece shift, which means the house was get cut down the middle into 3 seperate parts and relocated on the truck separately.

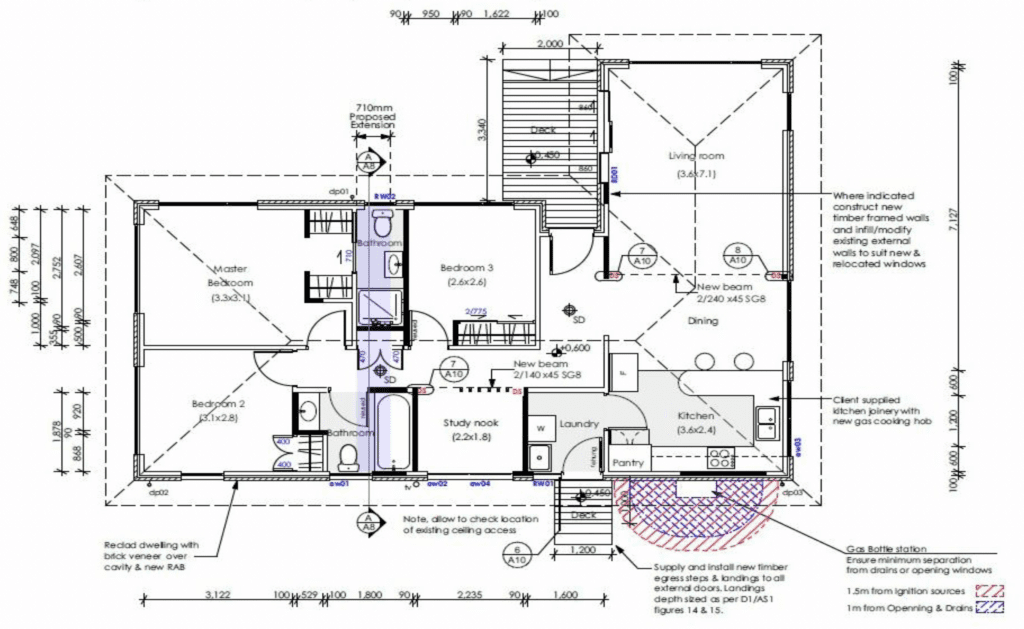

This then allowed me to extend the house by 710mm to add an ensuite to the Master Bedroom (now 3 Bed, 2 Bathroom) – Adding probably $30,000-$50,000 in resale value. (shaded purple below)

$130,000 Renovation: Full Reno for resale purposes, new kitchen, bathrooms, carpet, vinyl, Brick reclad, carport etc

Total Value $1,025,000: Approx value for both properties upon completion, separate titles CCC.

It now looks like this and is just needing some yard work and finishing touches, like a carport and deck.

So, while there are some downsides to consider, I still believe that relocating a house can be a smart and exciting option for many people.

As with any big decision, it’s important to weigh the pros and cons, do your research, and work with experienced professionals to ensure a smooth and successful outcome.

Don’t be afraid to think outside the box (or outside the new construction zone, in this case) and explore all your options when it comes to finding your dream home / lucrative investment.

I hope to hear from you soon,

Matt Willoughby

Financial Adviser | Mortgage Insurance ACC & KiwiSaver

P: 021 0221 7130

Matt Willoughby Limited, trading as OneStop Financial Solutions is a Financial Advice Provider (FSP702911). We hold a transitional license issued by the Financial Markets Authority (FMA). Please click here for OneStop Financial Solution’s disclosure statement.