When exploring home loan options, we often think of banks as our go-to source. However, in New Zealand, there’s an array of non bank lenders that offer competitive and flexible lending solutions.

These lenders can be a lifeline, especially for those who might not meet the strict lending criteria of traditional banks due to self employment, a less-than-perfect credit history, or other unique financial situations.

Non bank lenders have grown in popularity, providing tailored loan products that fit various needs. These can include:

- First home buyers with low deposits

- Buyer’s who’ve bought another home before selling their existing one

- Loans for home improvements and renovations without refinancing your existing mortgage

- Investment property loans

- Reverse mortgages for retirees

- Loans for construction, subdivisions and development

- Loans for business owners with equity in their existing mortgage

- Farming, livestock and rural loans

- And loans for those with poor credit history, or major life event that has negatively affected their borrowing power.

Our non bank mortgage brokers are highly experienced in non bank lending. We’ve gathered insights on some of the best non bank mortgage lenders in New Zealand, to help you understand how these loans can be used, and explore your options.

Table of Contents

Non Bank Mortgage Lenders in New Zealand

In New Zealand, there are many non bank mortgage lenders that offer a variety of loan products. Here’s a list of some notable non bank mortgage lenders in New Zealand:

Resimac New Zealand

- Products: Home loans, refinance options.

- Unique Selling Proposition: Flexible lending solutions for those with unique circumstances, such as self-employed individuals.

- Typical Customer Profile: Borrowers seeking alternatives due to not meeting traditional bank criteria.

- Application Process: Online application or through a registered non bank mortgage broker.

Resimac offers home loans for first-home buyers, investors, and those looking to refinance. They are known for providing flexible lending solutions, especially for those with unique circumstances.

If you look at their Google reviews getting in touch (and getting a response) from Resimac is pretty tough, and their direct customer service lets them down.

Despite this, they’ve won two Canstar awards in 2023 and the best non bank of the year in 2023 at the New Zealand Mortgage Awards.

The key here is written on their home page – talk to your adviser or mortgage broker. We have the contacts and know how to get in touch (and get a response) with Resimac.

Avanti Finance

- Products: Home loans, personal loans, car loans.

- Unique Selling Proposition: Quick processing and flexible loan terms.

- Typical Customer Profile: Individuals needing fast financing or those with varying income.

- Application Process: Streamlined online application with customer service support.

Avanti Finance provides a range of lending products including home loans, personal loans, and car loans. They are known for their flexible criteria and personal approach to lending.

They have a 3.6 star rating from 221 Google reviews. Their commitment to customer service is evident with all reviews receiving responses.

Liberty Financial

- Products: Home loans, car loans, business loans.

- Unique Selling Proposition: A wide range of products catering to different financial needs, including non-standard incomes.

- Typical Customer Profile: Wide range, from first-home buyers to investors and small business owners.

- Application Process: Comprehensive application process with options for both online and broker-assisted submissions.

Liberty Financial offers a comprehensive range of products including home loans, car loans, and business loans. Liberty is recognised for their flexible lending solutions that cater to a wide range of needs.

They lend up to 90% LVR and can be a good choice for those with low deposits. Liberty have been in the New Zealand market since 2007, and offer excellent flexibility with their loans such as extra repayments, redraw facilities, and both fixed and floating interest rate options.

Pepper Money

- Products: Home loans, personal loans.

- Unique Selling Proposition: Specialises in serving borrowers with adverse credit histories.

- Typical Customer Profile: Individuals with past financial difficulties seeking a second chance.

- Application Process: Focus on personalised service with both online and personal communication.

Like other non bank lenders on this list, Pepper Money provides loans to those who struggle to meet traditional lending criteria. Established in 2000, their products include home loans and personal loans.

Located in Auckland, they have a 4.6 star rating on Google, however, it’s important to note the 5 star reviews are over 12 months old. The most recent reviews appear to correlate with the sale of HSBC mortgages to Pepper Money, which was finalised in December 2023.

Bluestone Home Loans

- Products: Residential and commercial mortgages.

- Unique Selling Proposition: Custom solutions for self-employed and those with credit impairments. They don’t look at credit scores.

- Typical Customer Profile: Self-employed individuals needing documentation flexibility.

- Application Process: Requires detailed financial documentation; applications through accredited brokers.

Bluestone caters to PAYE borrowers, self-employed individuals requiring alternative income verification, and residential property investors with complex income streams. If you’re a discharged bankrupt, Bluestone may also be able to help.

Their website states loans for self employed start at 6.69% (as at the time of writing), but their Google reviews tell a different story, with one consumer citing an interest rate of 11.15% in 2023. Higher interest rates are normal with second tier lenders.

Unlike traditional lenders that use credit scorecards, Bluestone employs a holistic approach to assess loans, considering each borrower’s unique situation to ensure the best fit. If you’ve got diverse circumstances, Bluestone can be a good choice.

Heartland Home Loans

- Products: Residential loans, reverse mortgages, small business loans.

- Unique Selling Proposition: Specializes in reverse mortgages and flexible lending.

- Typical Customer Profile: Older homeowners looking for equity release options.

- Application Process: Offers both online applications and consultations with advisors.

Although Heartland is a registered bank, they offer services similar to non-bank institutions, with flexible products like reverse mortgages and small business loans.

Heartland were awarded Canstar’s 2023 award for outstanding value fixed rate loans. Their advertised fixed rate loans start from 6.19% (at the time of writing).

We put Heartland on this list of because of the unique products they offer. Reverse mortgages can help retiring Kiwi’s unlock equity, and their rural loan solutions include options for farmers, livestock finance, and transition loans for retirement.

When it comes to their reviews on Trustpilot, they’re mixed. 55% of people give them a 5 star review, but 25% also give them 1 star.

Non Bank Lenders for Bridging Loans, Investors and Developers

First Mortgage Trust

- Products: Property finance, commercial loans.

- Unique Selling Proposition: Specialises in secure property lending with competitive rates.

- Typical Customer Profile: Property investors and commercial developers.

- Application Process: Detailed proposal and security evaluation required.

First Mortgage Trust is a non bank lender for investment loans. If you’re looking to head into property development, need a construction loan, bridging finance or releasing equity, First Mortgage Trust is a great choice.

You need equity or capital if considering First Mortgage Trust. Their loan to value ratios are:

Residential:

- Land & Buildings in fee simple: up to 75%

- Sections in fee simple: up to 70%

- Leasehold land: up to 50%

Commercial or Industrial:

- Land & Buildings in fee simple: up to 66.7%

- Vacant land in fee simple: up to 50%

Rural:

- Land & Buildings in fee simple: up to 60%

- Vacant land in fee simple: up to 50%

Interest rates vary between 9.05% and 10.25% per annum, are subject to change, and were last reviewed in October 2023.

General Finance

- Products: Residential and commercial short-term loans.

- Unique Selling Proposition: Quick decisions and flexible terms for short-term financial needs.

- Typical Customer Profile: Borrowers needing bridge financing or short-term loans.

- Application Process: Fast application process, often requires real estate as collateral.

General Finance offers short and medium-term residential and commercial loans. They cater to investors, developers, and homeowners.

Offering home loans for up to 3 years, General Finance is an option for those looking for home improvement loans with fast approval times (sometimes 1-2 days at most).

They can help those with an impaired credit history, or if you are borrowing as a trust, partnership or company.

Their loan to value ratios are low, lending up to 69% of the value of the property for a first mortgage. Their bridging loan options are helpful if you have found another home to buy but haven’t sold your existing home yet.

Construction or development loans are also available for new builds, subdivisions or multi unit developments.

Southern Cross Partners

- Products: Short term lending of up to 2 years.

- Unique Selling Proposition: Focuses on tailored property finance solutions.

- Typical Customer Profile: Investors and builders needing flexible, short-term options.

- Application Process: In-depth evaluation of the property and borrower financials.

Southern Cross Finance offers loans for investment properties, development and construction, and land buying. They are short term solutions, with loan terms up to 2 years.

They are another non bank lender offering bridging finance, and can also help business owners release equity within their property to fund business purchases. Interest rates start around 9.25%.

A 100% NZ owned business, their team is based across the North Island as well as Wellington and Canterbury.

Overview of Non Bank Mortgage Lending in New Zealand

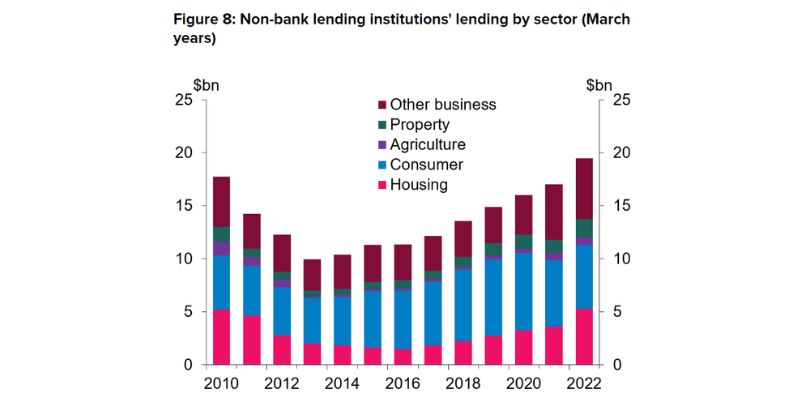

In New Zealand, we’re seeing a growing segment of the financial market dedicated to non bank mortgage lending. This alternative to traditional banking offers diverse home loan solutions and is playing an increasingly significant role in our housing market.

What Are Non Bank Mortgage Lenders?

Non bank lenders are financial institutions that offer mortgage lending without holding a traditional banking license. They’re a viable alternative for those who may not meet the strict lending criteria of major banks or for those seeking more tailored or flexible financing options.

The Role of Non Bank Lenders in the NZ Housing Market

Non bank mortgage lenders in New Zealand are important players in the housing market, especially for buyers who are otherwise unable to secure financing through a bank. While they hold a smaller portion of the market compared to banks, their impact is significant.

They contribute to a more inclusive lending environment, often having more lenient criteria or offering products designed for specific financial situations.

Comparing Non Bank Mortgage Lenders with Traditional Banks

When we compare non bank mortgage lenders with traditional banks, there are a few key differences to keep in mind.

Non bank mortgage lenders often offer more personalised application reviews and may provide loans when traditional banks say no, due to strict lending criteria.

On the flip side, banks usually offer lower interest rates and are perceived as more familiar institutions for many borrowers.

However, with both options now being well-regulated, deciding between the two comes down to specific needs and circumstances.

Advantages of Non Bank Lenders in 2024

When looking into mortgage options, we might find that non bank lenders offer some compelling advantages. These institutions can provide more tailored solutions for our unique financial situations.

Flexible Loan Terms and Conditions

Non bank mortgage lenders often pride themselves on flexibility. They may offer flexible loan terms, which can be particularly helpful if we have specific needs that don’t fit the traditional banking framework. This can range from longer loan periods to more accommodating payment schedules.

Solutions for Borrowers with Unique Circumstances

We’ve noticed that borrowers with unusual circumstances, such as a poor credit score or irregular income, can find solace in non bank lending solutions. These lenders typically have more lenient assessments and will work with us to understand our financial picture, not just our credit history.

Considerations for Borrowers

When we discuss non bank mortgage lenders in NZ, it’s essential we consider several factors that will influence our home loan journey. These include how much we can borrow in relation to the property’s value, the costs involved across the life of the mortgage, and the regulatory environment ensuring our protection.

Loan to Value Ratios (LVR) and Deposits

The LVR is a critical measure; it represents the percentage of the property’s value that you can borrow.

Some non bank mortgage lenders offer more flexibility if you are unable to meet the strict LVR requirements set by traditional banks.

You need to be aware that this could mean higher interest rates as the lender is taking on more risk.

Interest Rates and the Total Cost of Borrowing

When securing a home loan, interest rates are a primary consideration. Non bank mortgage lenders will almost always charge a higher interest rate than banks.

It’s important to look beyond the headline interest rates and calculate the total cost of borrowing over the life of the mortgage. Higher interest rates over time can significantly increase the total amount repaid.

Regulatory Aspects and Borrower Protection

In NZ, the Credit Contracts and Consumer Finance Act (CCCFA) regulates how loans are offered, including those by non bank lenders.

Non bank mortgage lenders are still required to operate within this regulatory framework, meaning they must assess loan applications carefully to ensure you can afford the repayments.

Working with non bank lenders can open doors to home ownership that might otherwise be closed.

However, we must carefully assess the LVR, total cost of borrowing, and regulatory protections before proceeding.

Specialist Services Offered by Non Bank Lenders

When we discuss non bank lending, remember they often provide more flexible solutions tailored to unique circumstances. Our approach is to guide you through various avenues to secure financing that fits your situation.

Non Bank Lenders for Self-Employed Individuals

For the self-employed, traditional loan applications can be a hurdle due to fluctuating incomes and non standard proof of earnings. Non bank mortgage lenders understand this and offer loan terms that are crafted to accommodate our enterprising clientele. By assessing your income more creatively, we ensure a fair evaluation for your loan application.

Bad Credit and Non Standard Loan Solutions

Individuals with a poor credit score or credit issues aren’t disqualified from owning homes. With our assistance, non standard loan solutions are accessible that help work around financial pasts.

By reviewing each case individually, we offer specialist advice and options like low deposit alternatives that take into account your unique circumstances. We will help you choose the right non bank mortgage lender so you’re not locked into something you may regret later on.

Bridging Loans and Second Mortgages

Sometimes, the timing between buying a new house and selling your old one doesn’t align. That’s where bridging finance solutions fit in, providing the necessary funds to bridge this gap.

If you’re seeking funding for major expenses or consolidating debt, we can discuss the option of a second mortgage, leveraging your property’s equity to meet those financial needs.

The Application Process with Non Bank Lenders

When you’re considering securing finance through non bank mortgage lenders, there is still an application process. We’ll guide you through each step, from establishing your eligibility to the support mortgage brokers provide.

Assessing Your Eligibility and Pre-Approval

First off, we need to determine if you’re a good fit for non bank lending. Initially, this involves a pre-approval stage; here’s what to expect:

- Review of your finances: We’ll look at your bank statements and assess income, expenses, and debts to understand your financial position.

- Loan suitability: Based on the above, we’ll gauge which loan terms might suit you best, whether it’s short term solutions or something more long-term.

- Tailored advice: Our mortgage brokers will give you recommendations specifically for your needs.

Documentation and Requirements

After you’ve got the green light on pre-approval, let’s gather the necessary paperwork for your loan application. Non bank lenders generally require the same type of information as traditional banks, such as:

- Proof of income: This could be payslips or, if you’re self-employed, tax returns.

- Financial statements: Up-to-date bank statements are essential to verify your financial behaviour. If you’re still in the planning stage, start thinking now about how you spend and what’s coming out of your accounts.

- Property details: If you’re purchasing property, details of the asset are essential.

Our journey with non banks is straightforward but meticulous. With access to many of the non bank mortgage lenders listed above, we’ll compare options across various non bank lenders to find the best fit.

Do You Think a Non Bank Mortgage Lender is Right for You?

At OneStop Financial Solutions, we understand the importance of finding a lending solution that aligns with your circumstances.

By considering non bank mortgage lenders, you stand to benefit from flexibility not always available through traditional banks.

While the share of non bank lending in New Zealand’s mortgage market may be small, it represents a significant sum and an important niche for borrowers seeking alternatives. Talk to our experienced mortgage brokers today.