June has continued with the upward trend in rising house prices throughout the whole country not just Auckland! Once again no real let up in sight.

How long can this continue? In my opinion simple – as soon as supply out strips demand. However based on all of the current factors things will only get worse. Unfortunately there simply isn’t enough (affordable) houses being built.

Furthermore listings are at an all time low while buyers are still out there trying to nab anything and everything! Yes it’s winter but a clear sign something needs to change.

But before I talk about this months topic here is my beautiful baby girl Madelyn Willoughby @ 3 1/2 Months old…

She is almost sleeping through most nights and is an absolute angel

Yes the photos are long over due sorry for the delay for all those who have been asking for them.

Interest Rates

Just this week the bank offered rates for one of my clients at 4.20% & 4.10% for the 1 and 2 years fixed respectively. This got me thinking why would anyone go for the 1 year when they could save 10 basis points and have another year of certainty? I hear you saying.

So in this post I want to offer some advice around the age old question of interest rates and which fixed rate terms are best and which ones you should be choosing.

When you break it down and dig around a bit, notice that banks always heavily promote one particular rate – what they are doing is driving customers to that part of the yield curve that will eventually benefit them the most (not you the customer).

E.g If rates are likely to rise on the horizon say 1 year from now then banks would put their best foot forward and show you a fantastic 1 year rate knowing full well that when this rate rolls over interest rates are on the up and your whole loan (for most people) is exposed. Year 2 and 3 they make their money back and then some!

Especially if you’ve been offered a cash or legals contribution and signed a waiver stating you’ll keep your business with the bank for 2-4 Years then you’re basically at the mercy of whatever rates they offer you!

In Marketing terms this is known as a ‘Loss Leader’ just like an online insurance company offering you 20% Cash Back for your first year…they know full well that the average Policy is held for 8 Years plus! Safe to say that the initial 20% is paid back to them pretty quickly huh?

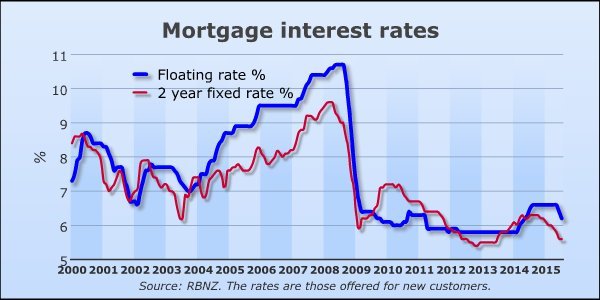

For more insight on this you only have to look back to 2008 when rates were higher. Basically the reverse was happening. Banks knew full well that globally things were about to be shaken up big time.

Never the less for a 3-4 month period the 1 Year rate

was around 10.25% or you could actually choose to fix @ 9.25% for 5 years! a lot of people naturally fixed for the 5 years without having the same insight in to the world markets as the banks. Within Months rates had crashed to around 5.0%!

Without a doubt the absolute best trick to avoid this is knowing the cycles and knowing what interest rates are going to do before hand. But even the experts get this wrong! No one has a crystal ball!

The next best ‘Trick’ is simply hedging your bets or ‘Interest Rate Averaging’. This is where you divide your Loan into segments and fix different portions at different interest rates and different terms. This way you’ll never make an awful decision but you might not ‘win big’ so to speak by choosing the lowest rate in the market either.

Let’s use a real live example of some recent rates with a $450,000 Loan with the following offer (Through the Broker Unit).

$3,500 Cash & Legal Contribution

4.90% Floating / Revolving Credit

6 mths 4.69%

1 Yr 4.20%

2 Yr 4.10%

3 Yr 4.39%

4 Yr 4.59%

5 Yr 4.79%

What would you choose? and why?

It all depends on your individual level of risk / certainty you prefer. For me personally I wouldn’t fix for anything longer than 3 Years in this current Mortgage Market. So My advice for them was to have $15-20k on the Revolving Credit (More to come next month on these) then either one third each on the 1, 2 & 3 year rates, or the same 15-20k Revolving Credit then half and half between the 1 & 2 Year terms.

So it would look something like this:

$15,000 – Flexi/ Revolving Credit

$145,000 – Fixed 1 Yr @ 4.20%

$145,000 – Fixed 2 Yrs @ 4.10%

$145,000 – Fixed 3 Yrs @ 4.39%

OR perhaps

$15,000 – Flexi/ Revolving Credit

$220,000 – Fixed 1 Yr @ 4.20%

$215,000 – Fixed 2 Yrs @ 4.10%

This way if interest rates do so happen to go up in the next year or so, their whole loan won’t be exposed to a rate hike – only approximately half. The same goes for lower rates they will be able to take advantage of the cheaper money for half their loan in a years time once their 12m rate rolls over.

Unfortunately many banks won’t even discuss these types of options with you they’ll simply show you the very best rate going at the time.

In fact I often hear my clients say that their bank said they weren’t actually allowed to separate their lending at all! It wasn’t until they discussed their situation with me that they then found out that this was even a possibility!

So if this is something you would like to consider or you would simply like some advice on your current situation please simply reply to this email or drop me a line: