I hope your summer was great and trust you have been enjoying the sunshine when it makes it’s brief appearances.

If you haven’t already now is a great time of year to reflect on last year’s achievements and perhaps set goals for this year.

We had a record year last year in the number of Mortgage Approvals with a very good chunk being 1st Home Buyers which is so great to see! Because of house prices the way they are, the majority of the buys (1st Home Buyers) were either apartments or tended to be in the ever increasing outer fringes of Auckland particularly South & West Auckland.

Otherwise due to the nature of the current Mortgage Market and recent decline of Interest rates over the last 6 months a large number of our clients and also a record number of new enquiries have been related to Refinancing.

Put simply Refinancing is switching your Mortgage from one Bank to another. Usually for the purposes of greater savings or sometimes due to a dislike or dissatisfaction of a current bank.

Here is a recent and fairly typical example of a couple that we helped Refinance their Mortgage.

Current Situation:

Home loan of $435,000

Fixed at 6.25% for 3 years with 26 months left to go

Cost of $4,400 to break the fixed rate (the bank penalises you this as a deterrent)

Current repayments are $2,869 per month on a 25 year term

New Situation:

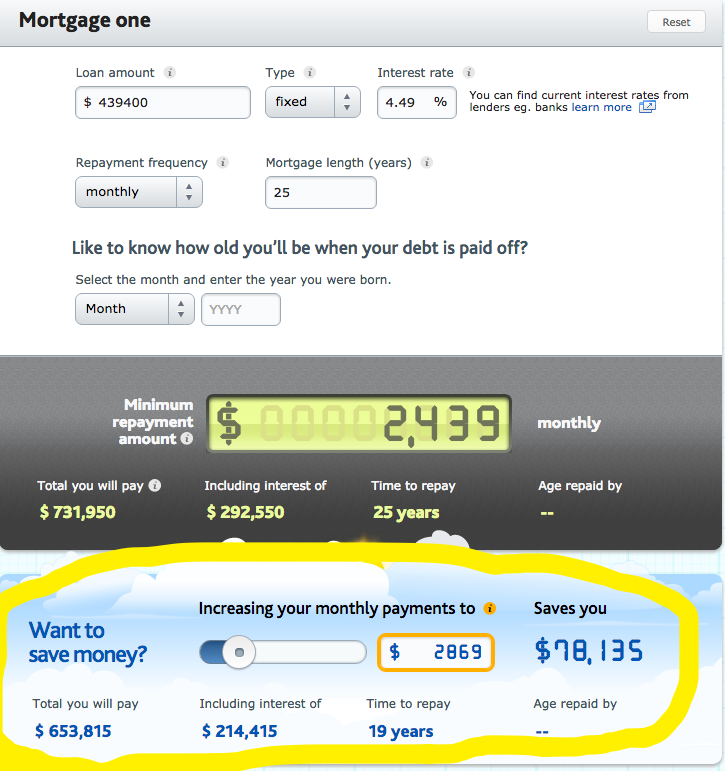

Home loan of $439,400 (Includes break fees + Home Loan)

Fixed at 4.49% for 3 years

New repayments $2,439 per month ($430 savings each month)

Cash back $3,500 (given to you, or put into your mortgage to reduce it, spend as you like)

Saving of $430 per month and $11,180 across the 26 months left to run on their original fixed term.

When they switched we advised them to leave their repayments the same at $2,869 per month then they would be debt free 6 years earlier and would save a whopping $78,135 in interest across the term of the loan. Money that otherwise would have gone to the bank as their profits…

Here are the exact Calculations using Sorted.org.nz

You probably have a few questions:

- Am I eligible?

- Is this right for me?

- How much does it cost? (the bank will often pay)

- What are the risks?

- Do I have to switch banks? (No, but sometimes it’s worth it)

- When can I refinance?

Feel free to give me a call if the above is relevant for you or any other property, mortgage or insurance related queries you may have.

You can catch me on 021 022 17130