How an Offset Mortgage Can Help you Save Thousands on your Home Loan

Channelling your everyday income and savings onto your mortgage can have a dramatic effect on the total interest payable and the term of your home loan.

Less interest charged, mortgage free faster! It’s that simple.

On average based on a $900,000* Home Loan our clients are on track to save no less than $220,000 in interest and shave 13 Years off the life of their loan.

It’s all about making your money work harder for you and not for your bank. Even if you only have a little savings and left over money every month, a personalised mortgage structure will work wonders for you.

This is the beauty with Revolving Credit and Offset Mortgages…

The downside with Revolving Credit is that there is one account only.

If you like to operate 3,5 or even 10 different bank accounts and they all have their designated reasons and purpose, then Revolving Credit will be an absolute nightmare for you.

With Offset Mortgages, depending on the bank you can have up to 50 different bank accounts linked to your Offset Mortgage and still reap the benefits!!

Yes you truly can have your cake and eat it too.

So How Does Offset Mortgage Work?

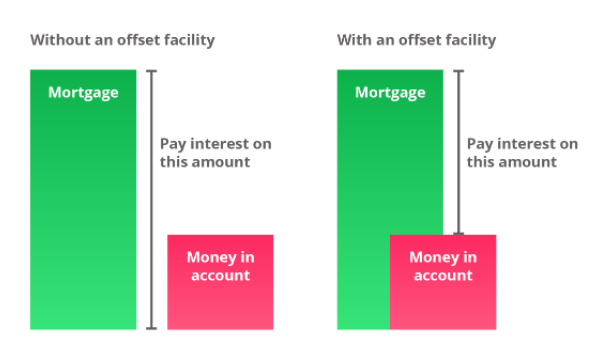

With an Offset Mortgage, your savings and everyday income is linked and Offsets (it’s in the name right!?) your Mortgage Interest.

Once again less interest charged = Mortgage Free Faster.

Examples and the Benefits:

- If you have a $500,000 mortgage and $40,000 in cash savings across ALL of your different bank accounts, you’ll only pay interest on $460,000.

- Yes for all intents and purposes your Mortgage is now only $460,000!

- You won’t earn any interest on your cash savings as you usually would while it’s part of the offset mortgage. Not to worry mortgage interest is far higher than interest you can find with a bank Term Deposit. Besides, any Interest you earn is actually Taxed (PIE Tax)!

- In case of emergency or loss of employment your everyday money and $40,000 savings is right at your disposal.

In our example on the video in this article, we presented a $500K mortgage and placed an Offset of $40K. It would look something like this

Surprisingly, this is a super quick and easy process where all of the leg work is handled by us. Chances are, with what could be as little as 20-30 mins of your time, this could translate to years off of your mortgage.

Get our advice for free

Great advice usually has a cost, but our expertise is free to first home buyers because the bank pays us! Banks pay us a commission because we are essentially doing all of the hard work for them. Most importantly we are strictly ‘unaligned’ which means we are not obligated to do business with one particular bank over any other, which means you’re always getting the best options and advice based on which bank is best for you.

Chat to a Financial Adviser About a Home Loan (No Cost, No Obligation)

Please complete your contact information and one of our specialist New Zealand mortgage brokers will be in touch.