Now that rates are much higher here in 2023, the Maths is clear.

It is probably much, much more beneficial (and safe) to pay off your loan faster. By doing so, you can save thousands in interest, whereas more than 2 Years ago when rates were around 2.49%, the benefit of paying off your loan early was much smaller.

By the way…

For those ‘Sharesies’, ‘Crypto’ and ‘Index Funds’ enthusiasts, just remember pre tax returns needs to be 10.48% (78% Tax) GUARANTEED in order for you to be better off investing money instead of saving interest on a Mortgage at 6.49%.

It’s all very well simply increasing your repayments, but the problem is:

- Your lifestyle changes

- What if you need access to this money again?

- Having a lack of emergency funds is stressful (and risky)

So are you familiar with an offset mortgage? How about revolving credit?

The answer is often “yes’, but very rarely is the setup correct. Oftentimes it is counter conducive to a client’s goals.

Unfortunately, after 10 Years in this amazing industry, I have noticed it is rare for someone who has never used an adviser in the past to have received personalised mortgage advice around these highly specialised bank products.

Contrast that with the large majority of my clients who are on track to pay off their loan in 22.8 Years (or sooner) without changing their lifestyle.

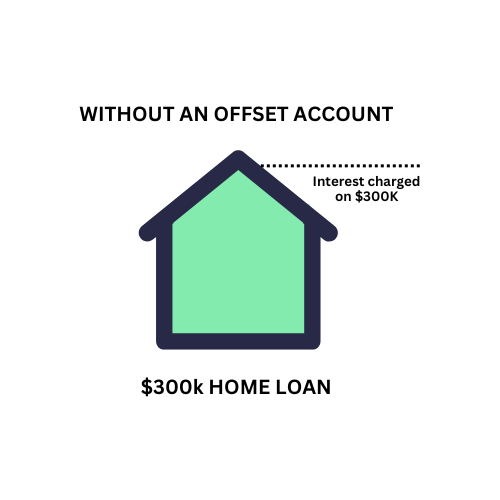

Here’s how an Offset Loan Works

Having an offset account can be a powerful way to reduce the amount of interest you pay on your mortgage by linking it to your savings and everyday accounts.

Your savings and everyday accounts are deducted (offset) from your mortgage balance, and you pay interest only on the remaining amount. This reduces your monthly interest costs and helps you pay off your home loan faster.

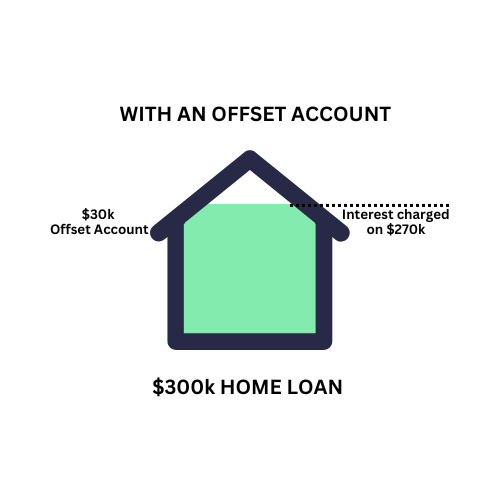

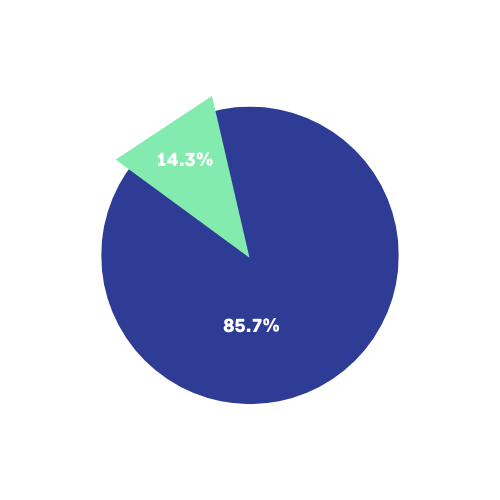

For example, you have a $300,000 mortgage and $30,000 in savings and across your everyday accounts. If you fixed the entire mortgage for two years at 6.49%, the repayments would be around $1,894 per month over a 30 year term.

In the first year, principal payments equate to roughly just $272 (14.3%) and interest the large majority is roughly $1,623 (85.7%).

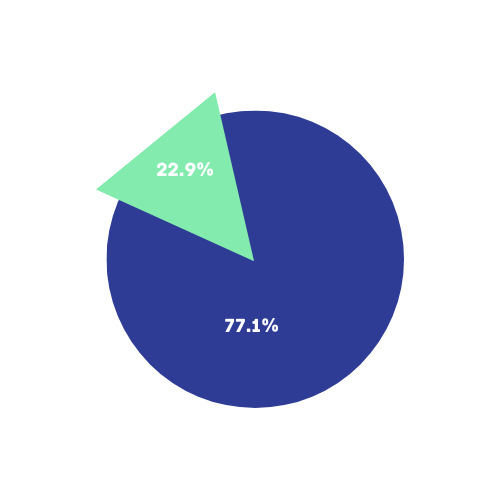

However, if you structured this loan to include an offset facility, where your $30,000 is linked to your savings and everyday accounts, you would only pay interest on the $270,000.

Side Note: Here is where offset accounts are different than revolving credit, your repayments stay exactly the same!!

What has changed is simply the amount of capital vs Interest being paid. $434 monthly are the principal payments and approx $1,460 is now that of interest.

The savings may seem small, but the maths is clear!

This clever loan structure has reduced the loan term on the mortgage to just 22 Years and 10 months instead of 30!

Or you can use these savings to build up your accounts or allocate them for other expenses.

Additionally, you can link the accounts of your children and parents if they bank with the same bank.

Another benefit with an offset account is that for couples who tend to have their accounts fairly separate, and each partner has multiple accounts for budgeting purposes, an offset account is amazing.

Side Note: Revolving credit aka ‘Flexi’ / Orbit is an absolute nightmare in this scenario!!

Downside of Offset Accounts

There are currently only three banks that offer an offset mortgage product, so it’s worth considering if it aligns with your overall mortgage strategy. E.g investment loans on interest only may have a small-zero advantage.

Currently Banks are offering large cash-back incentives e.g 1.00% of the total loan amount (up to limits).

By linking your accounts, you can reduce interest payments while having the reassurance that your funds are readily available when needed.

Get Started

If you wish to get started from here the first step is to create and complete your online profile here.

From here you will get your own personalised lending & affordability calculator emailed to you, and from there you can book a time with Matt to discuss your exact home loan savings.

Matt Willoughby

Financial Adviser | Mortgage Insurance ACC & KiwiSaver

P: 021 0221 7130

Matt Willoughby Limited, trading as OneStop Financial Solutions is a Financial Advice Provider (FSP702911). We hold a transitional license issued by the Financial Markets Authority (FMA). Please click here for OneStop Financial Solution’s disclosure statement.